From Zero to World’s Biggest Crypto Exchange in Just 6 Months

Editor’s Note: A few months ago, Coin Central published a review of an “up and coming” cryptocurrency exchange called Binance. Since then, Binance has rapidly grown to become the number one cryptocurrency exchange in the world. With such rapid growth, we’ve updated and expanded our original review in this new article…

—

Binance is currently the world’s largest cryptocurrency exchange, with over $6 billion in assets traded in an average 24 hour period. Binance’s rise to the top has been swift. Since its launch six months ago, Binance has grown at a rapid rate. Millions of users per week sign up to use the exchange, including 240,000 members last Wednesday alone. Wednesday’s daily record came after Binance lifted a temporary freeze on new member registrations.

Binance is also the name of a cryptocoin (BNB) traded and used on the Binance exchange. Since the ICO six months ago, the value of BNB has risen with the growth of the exchange. BNB is now among the top 30 cryptocurrencies in the world by market cap.

What about Binance makes it so compelling? Why are so many people signing up to use this new exchange? In this article, we’ll dive into those questions. The answers are surprisingly simple. The simplicity of Binance’s business model has been the key to its success so far, and it bodes well for future success.

How Exchanges Work: Understanding Binance’s Advantage

First, it’s worth understanding the basic mechanics of a currency exchange before we go any further. Solving some technical problems with exchange software is among Binance’s key competitive advantages.

Matching

A typical exchange works as a market maker for buy and sell orders. It’s important to note that the exchange itself does not buy and sell your currency when you make an exchange. Instead, the exchange matches you with another user who is willing to buy your asset at the price your asking. This matching of buy/sell orders is the key function of an exchange. When an exchange matches buy/sell orders and completes a trade, it charges a transaction fee to both parties for the service of finding a match. That’s how exchanges make money.

This order matching creates a bottleneck for many cryptocurrency exchanges. If you have more trade requests than your matching software can handle, orders will be delayed. With the popularity of Bitcoin and altcoins right now, users are submitting millions of trade requests per minute on the most popular exchanges. Delayed trades might be the difference between capitalizing on an investment opportunity and missing it.

Binance’s major innovation is their matching engine, capable of 1.4 million trades per second. This makes their trading platform one of the fastest available on the market. As such, many crypto investors have flocked to Binance for its processing speed.

Liquidity

The other critical component of an exchange is liquidity. Liquidity is the amount and frequency with which assets move around the exchange. In order to quickly find a match and complete an order at a competitive price, there needs to be a lot of activity on the orderbook. An exchange with a quiet orderbook is not a good place to invest your money. However, Binance has the busiest orderbook in the world, making it a safe, competitive market for transactions.

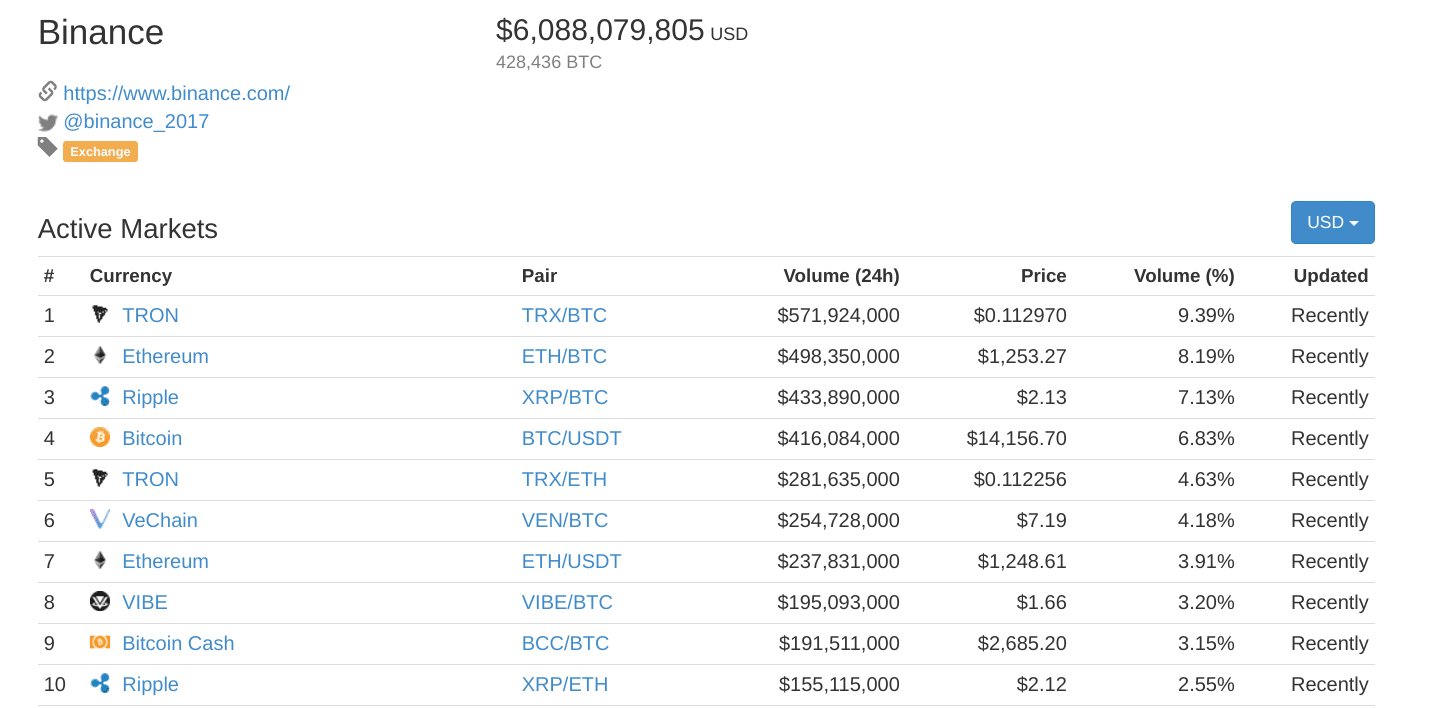

Most-traded asset pairs on Binance in the past 24 hours

Binance has high liquidity in many different assets, not just Bitcoin and other top coins. In fact, as of writing, TRON is the most-traded asset on Binance in the past 24 hours, with other altcoins in the top ten. This altcoin advantage is a virtuous cycle for Binance, and new coins often choose to list with Binance over competing exchanges. This includes many coins from Asia that may not be available from Western-based exchanges. The wide array of assets available is another key reason for Binance’s rapid rise.

Using the Binance Exchange

Binance does not support fiat currencies, so you can’t convert dollars, yen, pounds, euros, etc. on the exchange. (The name Binance is actually a combination of “Binary Finance,” suggesting that they only deal in digital assets.)

If you want to use Binance, you’ll need to already own cryptocurrency. Once you do, registration and setup are fairly easy, as is funding your Binance account.

User Experience & Interface

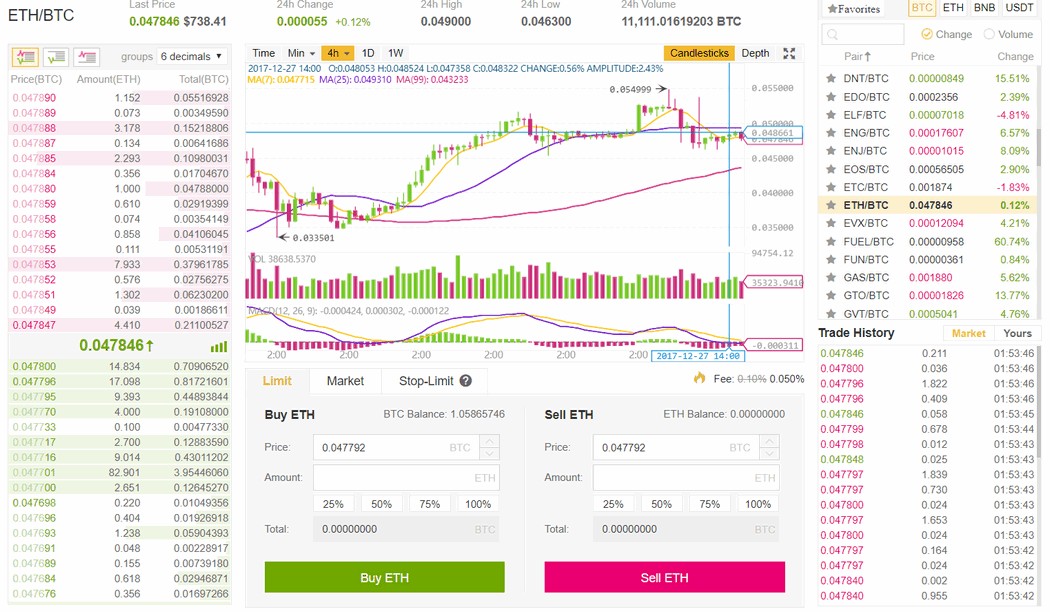

Binance’s User Interface

Binance has done a great job building an intuitive user interface without sacrificing the charts, graphs, and other information you need to make informed investment decisions. Trading is easy and only requires a few clicks to select the currency pair you’d like to trade and create the order. The user interface is available online, but also as a mobile app for iOS and Android.

Another factor contributing to Binance’s rapid growth is its availability in eight different languages. The exchange supports users that speak English, Chinese, Japanese, Korean, Russian, Spanish, French, and German.

Low Fees

The final key to Binance’s success is the competitive trading fees it charges. It’s free to fund your account, and orders are charged a simple 0.1% trading fee. The trading fee means you’ll want to limit how frequently you make trades since you’ll lose 0.1% every time you transact. However, we’ll see in a minute that Binance makes it possible to reduce these transaction fees. If you consider how much Binance makes off its transactions, it’s clearly a profitable business model. With over $6 billion traded in a 24 hour period, even if Binance only receives 0.05% of that daily volume, that’s $30 million in revenue per day.

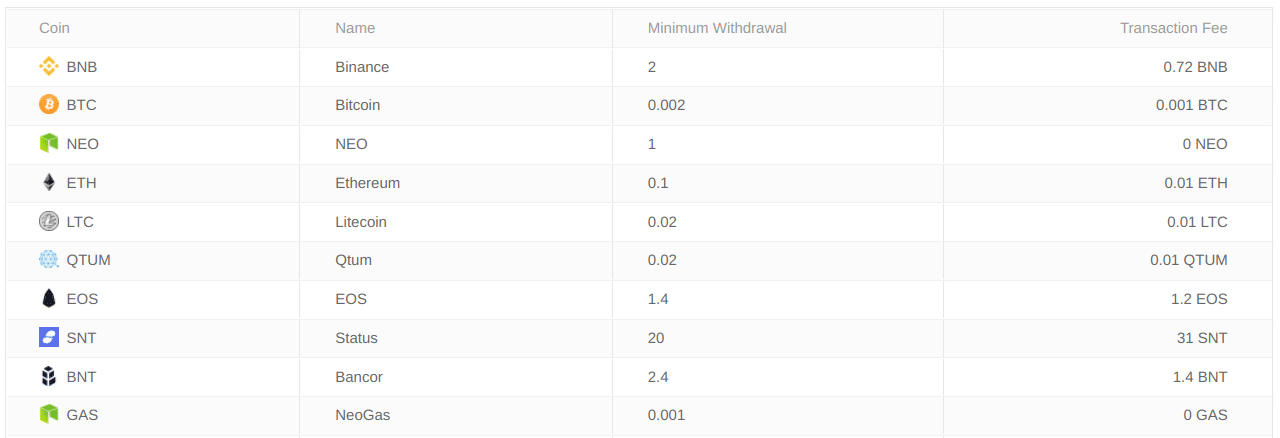

Binance also charges withdrawal fees for moving assets out of your account into private wallets. The withdrawal fees vary by the coin, but they are flat fees, not percentage-based.

Examples of Binance withdrawal fees

The Binance Coin (BNB)

Along with the launch of the exchange, Binance launched an ICO. BNB is an ERC20 token built on Ethereum. The total supply is limited to 200 million BNB, after which no more coins will be created.

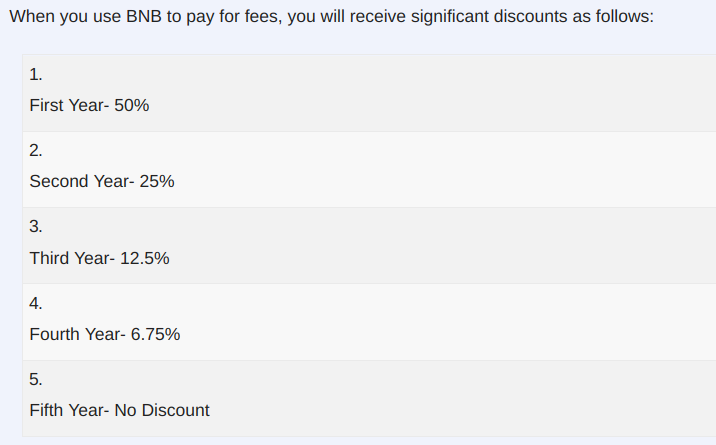

You can use BNB to pay your fees on the Binance exchange. While you can still choose to pay your fees in the cryptocurrency you’re exchanging, Binance offers a rebate as an incentive to pay fees in BNB. In your first year of membership on Binance, fees are discounted 50% when paid in BNB. With every subsequent year of membership, the fee discount decreases. By your fifth year using Binance, there is no longer a fee discount for paying in BNB.

Binance fees over time

Since the fee rebate decreases every year, the value of the BNB token is also expected to decrease over time. To combat this depreciation, Binance will also destroy BNB tokens over time, reducing the total supply of BNB from 200 million to 100 million. Contracting the money supply in this way should counteract the effects of the decreasing discount. The goal being a stable price for BNB coins over time.

While fee payment is the primary purpose of the BNB token, you can also use it to invest in certain ICOs that participate in Binance’s Launchpad program. Once the ICO is over, these new tokens will automatically list on Binance, creating a seamless marketplace between ICO and exchange.

The Future of the BNB Token

Binance is promoting the adoption of the BNB token in the hopes that it will drive customer loyalty. The rebate, of course, is a nice perk for lowering trading fees. But even after the rebate decreases, users are still likely to own leftover BNB that they might as well continue to use. As the dominant cryptocurrency exchange in the world, we can expect Binance’s coin to circulate widely. The more its adoption grows, the more valuable and useful it becomes.

Right now, BNB’s primary value is within the exchange. This makes BNB unique among most new coins since it already has a practical use case. Most investors will get the highest ROI out of cashing in on the BNB rebate. However, in the future, it’s possible the value of BNB could grow as an asset. For the earliest investors, they’ve already seen a large return on BNB. It’ll be interesting to see if investors continue to take the rebate or hold BNB in hopes that it will appreciate.

If Binance sees continued success on its current level, it will certainly implement more features and programs. These new capabilities and add-ons will all likely use the BNB coin. Their ICO Launchpad is one early example of an added feature using the BNB coin. There are likely to be many more.

Where to Buy & Store BNB

You can only purchase BNB through the Binance exchange and EtherDelta (although the volume on EtherDelta is so low that you shouldn’t bother). Any coin supported on Binance is available as a trading pair with BNB.

If you’re interested in holding BNB as an investment, you should move it off the exchange into a wallet. As an ERC20 token, your BNB can be stored on MyEtherWallet. For improved security, you can also use a hardware wallet like the Trezor.

Binance Background & Team

Binance is a Chinese company, originally started in Shanghai and now based in Hong Kong. It’s founder, Changpeng Zhao, is the former CTO of OKCoin, another prominent Chinese cryptocurrency exchange. Zhao’s company, Beiji Technology, owns and operates Binance.

The Binance exchange only launched six months ago. In August 2017, shortly after launch, Binance announced that Yi He would join the team. Yi He was one of the original co-founders of OKCoin. She’s widely recognized for her ability to grow technology products and gain user adoption. Zhao, He, and the Binance team have grown the company into the biggest exchange in the world over the past six months.

Conclusion

There’s a reason why Binance has seen such massive growth and success over the past six months. It’s fast, reasonably priced, and available worldwide. If you already have an exchange that you use and like (that charges similar fees), then there’s no need to switch to Binance. In particular, if you often need to convert to fiat currency, Binance won’t be useful for you at all. However, if you’re unhappy with your current exchange, need lower fees, or are looking for the fastest processing times available, then a move to Binance could be right for you.

- Crypto()Currency - CryptoCurrency.org [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Cryptocurrency - Wikipedia, the free encyclopedia [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- TNW - Stefan Molyneux - Money, Power and Politics The Cryptocurrency Revolution - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- How to Set Up a Ripple (CryptoCurrency) Generating System! - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Bitcoin / Cryptocurrency - An Extensive FAQ - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- --- The Great Debate --- Bitcoin vs Altcoin @ The CryptoCurrency Convention 4/9/14 - - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Bryce Weiner @ CryptoCurrency Convention 4/9/14 - - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Popularcoin @ CryptoCurrency Convention 4/9/14 - Joshua Nold - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- TimeKoin @ CryptoCurrency Convention 4/9/14 - Michael Brown - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Infinitecoin @ CryptoCurrency Convention 4/9/14 - Loring Small - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Bitcoin Exchange CryptoRush Loses Millions of BlackCoin Cryptocurrency - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Brock Pierce, Entrepreneur "FireSide Chat" @ CryptoCurrency Convention NYC - 4/9/14 - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- [OFFICIAL SPONSOR] Nick Spanos, Bitcoin Center NYC @ CryptoCurrency Convention 4/9/14 - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- AuroraCoin @ CryptoCurrency Convention NYC 4/9/14 - David Lio - Video [Last Updated On: April 26th, 2014] [Originally Added On: April 26th, 2014]

- Dogecoin Founder Speaks on the Future of Cryptocurrency [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- As Bitcoin Soars in Value, Alternative Cryptocurrencies ... [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- Florincoin @ CryptoCurrency Convention NYC 4/9/14 - Joe Fiscella - Video [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- DigiByte @ CryptoCurrency Convention NYC 4/9/14 - Jared Tate - Video [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- Digitalcoin @ CryptoCurrency Convention NYC 4/9/14 - Andrew Davidson - Video [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- PotCoin @ CryptoCurrency Convention NYC 4/9/14 - Nick Iversen - Video [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- ZenithCoin @ CryptoCurrency Convention NYC 4/9/14 - Eddie Corral - Video [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- BitAngels Co-Founder, David Johnson @ CryptoCurrency Convention NYC 4/9/14 - Video [Last Updated On: April 27th, 2014] [Originally Added On: April 27th, 2014]

- Australian dogecoin founder speaks on the future of cryptocurrency [Last Updated On: April 28th, 2014] [Originally Added On: April 28th, 2014]

- Coinnext Cryptocurrency Exchange Coming Soon - Video [Last Updated On: April 29th, 2014] [Originally Added On: April 29th, 2014]

- Cryptocurrency News Round-Up: MtGox Hearing Begins as Bitcoin gets Bloomberg Endorsement [Last Updated On: May 1st, 2014] [Originally Added On: May 1st, 2014]

- mTrader.org - Cryptocurrency Mining System - Video [Last Updated On: May 1st, 2014] [Originally Added On: May 1st, 2014]

- CryptoCurrency - cryptobars commodity Launch! - Video [Last Updated On: May 1st, 2014] [Originally Added On: May 1st, 2014]

- The Mises View: "Taxing Cryptocurrency" | Jeff Deist - Video [Last Updated On: May 2nd, 2014] [Originally Added On: May 2nd, 2014]

- Coin Pursuit Launches SliceFeeds Interactive Cryptocurrency Network [Last Updated On: May 3rd, 2014] [Originally Added On: May 3rd, 2014]

- Cryptocurrency | Ground Zero with Clyde Lewis [Last Updated On: May 3rd, 2014] [Originally Added On: May 3rd, 2014]

- CS 171 Final Project: Cryptocurrency Visualizations - Video [Last Updated On: May 3rd, 2014] [Originally Added On: May 3rd, 2014]

- Cryptocurrency Explained The Tech Guy 1046 - Video [Last Updated On: May 3rd, 2014] [Originally Added On: May 3rd, 2014]

- Know How 74 Cryptocurrency - Video [Last Updated On: May 4th, 2014] [Originally Added On: May 4th, 2014]

- MIT undergrads will each receive $100 in bitcoin [Last Updated On: May 5th, 2014] [Originally Added On: May 5th, 2014]

- cryptocurrency - Fortune Finance: Hedge Funds, Markets ... [Last Updated On: May 8th, 2014] [Originally Added On: May 8th, 2014]

- Bitcoin wins US election panel's approval for political donations [Last Updated On: May 9th, 2014] [Originally Added On: May 9th, 2014]

- CryptoCurrency of the World Unite! - Video [Last Updated On: May 9th, 2014] [Originally Added On: May 9th, 2014]

- Major Dogecoin Wallet Hacked, Shut Down [Last Updated On: May 13th, 2014] [Originally Added On: May 13th, 2014]

- Such hack, much sad: Doge Vault reportedly loses $56,000 in heist [Last Updated On: May 13th, 2014] [Originally Added On: May 13th, 2014]

- BBT Presents: Ode to Cryptocurrency - Video [Last Updated On: May 13th, 2014] [Originally Added On: May 13th, 2014]

- Scryptify Cryptocurrency Video - Crypto Currency Exchanges - Video [Last Updated On: May 13th, 2014] [Originally Added On: May 13th, 2014]

- AMD cuts Radeon R9 280 price as inflation woes die down [Last Updated On: May 15th, 2014] [Originally Added On: May 15th, 2014]

- The Cryptocurrency Certification Consortium - Video [Last Updated On: May 15th, 2014] [Originally Added On: May 15th, 2014]

- Bitpagar Cryptocurrency - Video [Last Updated On: May 16th, 2014] [Originally Added On: May 16th, 2014]

- TagPro - Cryptocurrency Juke Session w/ LTB & Counterpary - Video [Last Updated On: May 16th, 2014] [Originally Added On: May 16th, 2014]

- How to Mine Cryptocurrency Safely - Video [Last Updated On: May 16th, 2014] [Originally Added On: May 16th, 2014]

- Bunnycoin - Innovative New Cryptocurrency - Video [Last Updated On: May 16th, 2014] [Originally Added On: May 16th, 2014]

- Jan Irvin on Learning, Statism, Culture, Cryptocurrency and Voluntarism -- Potent News Podcast #1 - Video [Last Updated On: May 16th, 2014] [Originally Added On: May 16th, 2014]

- Nxt cryptocurrency platform: Proof of Stake mining system - Video [Last Updated On: May 18th, 2014] [Originally Added On: May 18th, 2014]

- Cryptocurrency Round-Up: Darkcoin Rise Continues; Dogecoin Saved My Life & Bitcoin Explainer Videos [Last Updated On: May 19th, 2014] [Originally Added On: May 19th, 2014]

- Givecoin.info Announces Partnership with Do A Bit of Good: World's First Charitable Mining Screensaver [Last Updated On: May 21st, 2014] [Originally Added On: May 21st, 2014]

- Cryptocurrency: Get Mining! - Video [Last Updated On: May 22nd, 2014] [Originally Added On: May 22nd, 2014]

- Violincoin - The first cryptocurrency for musician - - Video [Last Updated On: May 22nd, 2014] [Originally Added On: May 22nd, 2014]

- Trollcoin - The Fun Cryptocurrency! - Video [Last Updated On: May 22nd, 2014] [Originally Added On: May 22nd, 2014]

- Cryptocurrency and Nonprofits with Eric Nakagawa - Video [Last Updated On: May 23rd, 2014] [Originally Added On: May 23rd, 2014]

- The Cryptocurrency Store - Video [Last Updated On: May 23rd, 2014] [Originally Added On: May 23rd, 2014]

- The Cryptocurrency Store (Spanish/Espagnol) - Video [Last Updated On: May 23rd, 2014] [Originally Added On: May 23rd, 2014]

- How To Trade CryptoCurrency: Sign up to a safe and reliable exchange for trading CryptoCurrency - Video [Last Updated On: May 23rd, 2014] [Originally Added On: May 23rd, 2014]

- UT students to launch cryptocurrency exchange [Last Updated On: May 24th, 2014] [Originally Added On: May 24th, 2014]

- Videoconferencia Cryptocurrency 201243946 - Video [Last Updated On: May 27th, 2014] [Originally Added On: May 27th, 2014]

- VideoCharla Jesus Ramos Cryptocurrency - Video [Last Updated On: May 27th, 2014] [Originally Added On: May 27th, 2014]

- Cryptocurrency Round-Up: Bitcoin Pioneer Dies and Digital Currency's Status in Australia [Last Updated On: August 31st, 2014] [Originally Added On: August 31st, 2014]

- Bitcoin enthusiasts discuss the cryptocurrency - Video [Last Updated On: August 31st, 2014] [Originally Added On: August 31st, 2014]

- Make Fast 1.0 up to 10.00 BTC or Any Cryptocurrency REAL CASH - Video [Last Updated On: August 31st, 2014] [Originally Added On: August 31st, 2014]

- Halcyon cryptocurrency - Video [Last Updated On: August 31st, 2014] [Originally Added On: August 31st, 2014]

- Selling products / services / fiat money for cryptocurrency - Coinkite PoS Terminal - Video [Last Updated On: August 31st, 2014] [Originally Added On: August 31st, 2014]

- Selling cryptocurrency to customers - Coinkite PoS Terminal - Video [Last Updated On: August 31st, 2014] [Originally Added On: August 31st, 2014]

- Cryptocurrency Made Simple - A Plain English Guide to Bitcoins [Last Updated On: September 8th, 2014] [Originally Added On: September 8th, 2014]

- PotatoCoin - The cryptocurrency for the third world - Video [Last Updated On: September 8th, 2014] [Originally Added On: September 8th, 2014]

- How To Trade One Kind Of Cryptocurrency For A Different Kind Of Cryptocurrency - Video [Last Updated On: September 8th, 2014] [Originally Added On: September 8th, 2014]

- How To Fund Your Bleutrade Cryptocurrency Trading Account - Video [Last Updated On: September 8th, 2014] [Originally Added On: September 8th, 2014]

- How To Open An Account At Bleutrade.com Cryptocurrency Exchange - Video [Last Updated On: September 8th, 2014] [Originally Added On: September 8th, 2014]

- Cryptocurrency Round-Up: Apple Pay Boosts Bitcoin, Nakamoto Negotiates With Hacker [Last Updated On: September 11th, 2014] [Originally Added On: September 11th, 2014]

- Qoinpro Cryptocurrency Faucet ok - Video [Last Updated On: September 12th, 2014] [Originally Added On: September 12th, 2014]

- Weekly Roundup - CEX.IO - Multi-Functional cryptocurrency exchange - Video [Last Updated On: September 12th, 2014] [Originally Added On: September 12th, 2014]

- TCR #27: Cryptocurrency growth, 9/11 Anniversary, CDC Scandal, Face Your Fears - Video [Last Updated On: September 12th, 2014] [Originally Added On: September 12th, 2014]

- VanosEnigmA 011 Bitcoin-Comedy BitcoinDog CryptoCurrency-Cat Naughty - Video [Last Updated On: September 15th, 2014] [Originally Added On: September 15th, 2014]

- WikiLeaks Avoided Bitcoin to Prevent Government 'Destroying' Cryptocurrency [Last Updated On: September 16th, 2014] [Originally Added On: September 16th, 2014]

- LXC Coin crowdfunds in challenge to Bitcoin [Last Updated On: September 16th, 2014] [Originally Added On: September 16th, 2014]

- Why Bitcoin Is Poised To Win Big In Las Vegas [Last Updated On: September 19th, 2014] [Originally Added On: September 19th, 2014]