After spending a year in prison, Bitcoin pioneer Charlie Shrem has a new job and a new mission: Strengthening the ecosystem of blockchain assetsand, just maybe, helping build the future of the Internet.

My word is gold, says Charlie Shrem, glass of absinthe in hand, light winking off a pinkie ring he wears that is embossed with a Bitcoin symbol. And I make sure everyone gets paid.

Bitcoins first felon is in his favorite mode: full-on bluster. Were in Sarasota, where he lives, perched on stools at Pangea Alchemy Lab, a faux-speakeasy tucked behind a curtain in the back of a sandwich shop. The bartender is a bearded anarchist who, after making our drinkshe drips water from a sort of four-armed decanter onto sugar cubes suspended on slotted spoons above glasses of French absintheasks if Ive read Debt: The First 5,000 Years , by the anthropologist David Graeber. Shrem has been offering plenty for the bartender to eavesdrop on, a discourse that features words like Bitcoin, blockchain, digital currency.

Before his fall from grace, Shrem was living the high life as a Bitcoin millionaire . Now, at 27, he once again has something to prove. Ten months after his release from federal custody, he has a new job, and hes looking to mount a comeback.

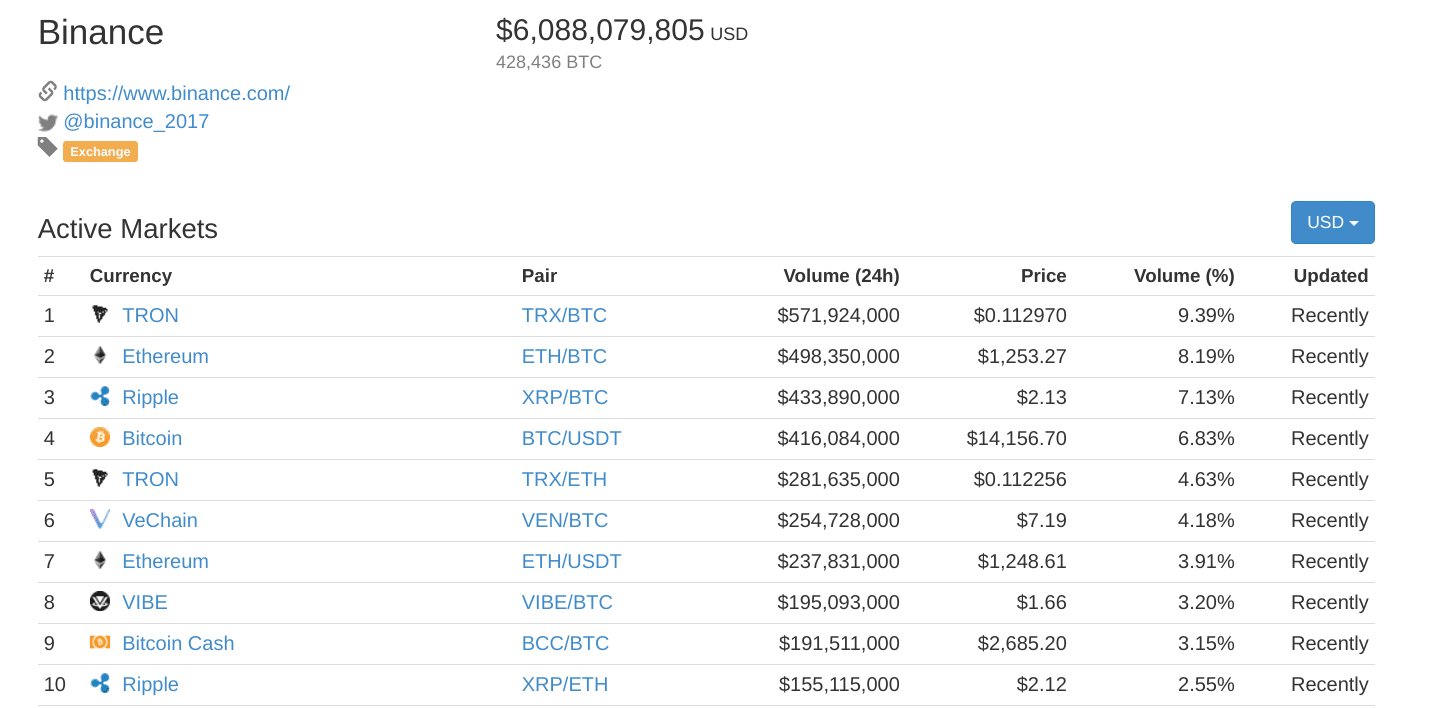

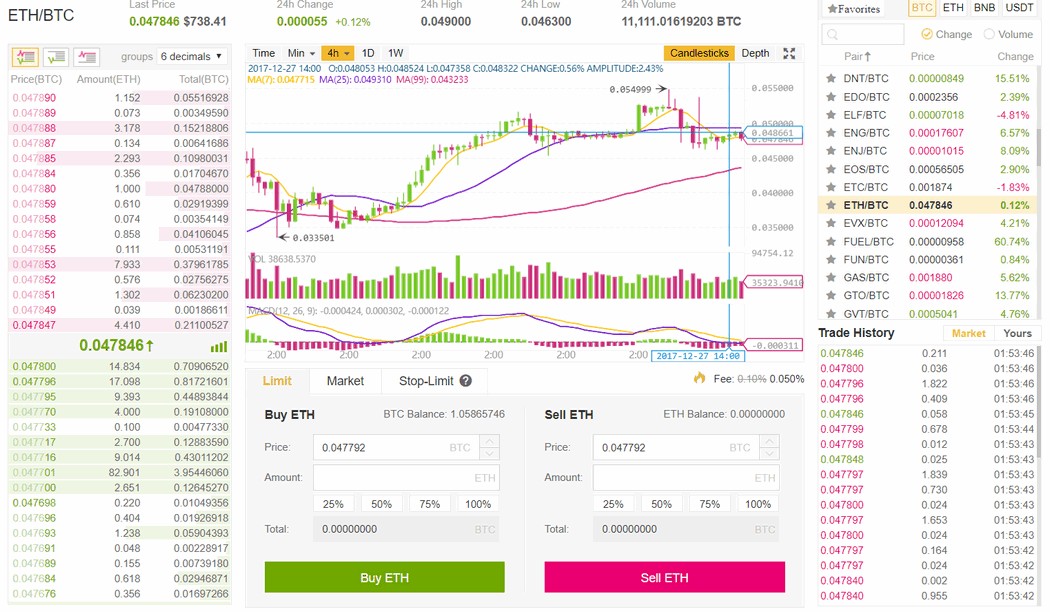

Its happening just as digital currencies are in the midst of an epic explosion. Bitcoin and its ilk are now worth $107 billion, six times their value at the beginning of the year. Its either the beginning of a global financial realignmentor a bubble of historic proportions. These days as much as $6.6 billion in digital tokens changes hands every day, and even mainstream players such as Goldman Sachs ( gs ) , Visa ( v ) , Capital One, Nasdaq, and the New York Stock Exchange have invested in the underlying technology.

Shrem saw value back when Bitcoins were worth only a few dollars eachthey now trade above $2,600and there was hardly anything to spend them on. In 2011 he cofounded a startup, BitInstant, that became one of the biggest early cryptocurrency companies. At one point, it was processing about a third of all Bitcoin transactions, before flaming out in 2013. You talk to 10 people, says Shrem, I guarantee you at least seven of them will say they got their first bitcoin from BitInstant.

Shrem is a natural-born impresario, a promoters promoter, and he was one of the first public faces of the cryptocurrency phenomenon. In 2013, when GQ needed a spirit guide to the shadow realm of digital currency, it relied on Charlie Shrem. He was featured in the documentary The Rise and Rise of Bitcoin. He was a speaker and proselytizer at industry conferences. And he cofounded the Bitcoin Foundation, the first nonprofit advocacy group for digital currency.

But Shrem crashed as fast as he rose. In March 2015 he went to federal prison after pleading guilty to helping a customer acquire Bitcoins to resell on the underground marketplace Silk Road, where Bitcoin was used to buy drugs.

Today Shrem is a free man again, and his world has dramatically changed. Bitcoin was the only digital currency when he was first in the game. Now its less importantnot because it has imploded, as critics long predicted it would, but because it has given rise to hundreds of new digital assets.

He is embracing the transformation. There wont be one supreme digital currency, he and others agree. A kind of crypto-pluralism is taking hold. In early March, when I first catch up with Shrem, Bitcoins share of the total market cap of all cryptocurrencies is about 85%. By June 12 it is 41%, an all-time low. To be clear, Bitcoins price hasnt fallen; in fact, it has soared (see chart below). But many leading rivals have soared even faster.

Shrem is a connector, not a coder, and hes positioning himself to play a key role in this newly diverse ecosystem. He has already stumbled once in his comeback, with one venture crashing almost instantly, before landing a job at Jaxx, a startup that allows users to hold separate balances of different virtual coins in digital wallets.

Shrem embodied the chaotic, legally questionable early days of cryptocurrency. But he says hes different now. He claims hes no longer operating mainly for himself and instead wants to use his talents to strengthen the crypto-community.

Charlie Shrem is nobodys image of a traditional financier, but thats precisely the point with alternative currencies: Their early leaders were the sorts of people who would never pass muster at, say, Morgan Stanley . That may just make Shrem the perfect messenger, as digital currencies transition from an off-the-grid form of exchange favored by people who reviled any established system into something that is fast becoming an established system of its own.

The promise of bitcoin, when it came into the world in 2009, was to be a universal currency, electronic cash that could be sent around the globe in minutes and that would work as well in New Delhi as it did in New York. Its scarcity is predetermined by the code: New bitcoins are introduced into the system at regular intervals through a process called mining. The word is misleading, since this form of mining consists of solving the complex math problems necessary to confirm transactions on the network. Successfully solving the problems triggers the creation of more digital currency.

Bitcoins pseudonymous creator, Satoshi Nakamoto, built a decentralized system that no one would own but anyone could participate in. A constantly updated copy of the ledger recording all Bitcoin transactionsthe blockchainwould be stored on the computer of anyone running the software. Although the ledger was open to all, Bitcoin transactions were meant to be anonymous.

Blockchain technology is groundbreaking because it allows transactions to be processed without recourse to a central authority, such as a payments company, government, or bank. Businesses and services can be decentralized, cutting out costly middlemen and removing single points of failure.

But only eight years after its launch, Bitcoin is showing strain. A civil war has been raging over its future. Due to limitations in its code, the Bitcoin network can process only seven transactions a seconda trifling quantity for any system that aspires to serve the masses. (Visa handles thousands of transactions per second.) As the load has increased, the time it takes to confirm transactions has risen sharply, and users have been at odds over how to solve the problem. The bickering threatens to divide the currency into two competing versions of Bitcoinor condemn it to obsolescence.

Not only is Bitcoin slower than some of its younger rivals, its also more limited. Yes, Bitcoin allows the transfer of value. But many of the new systems can be used for much more. Ethereums creators , for instance, have built a potentially more versatile network by incorporating a scripting language that allows developers to create smart contractsagreements written into the software that can dispense funds and perform other functions automatically in response to preset triggers.

All of which means Bitcoin faces a threat from younger, more nimble rivals. Their names are legion: Litecoin. Zcash. Monero. Dash.

Dasha portmanteau of digital cashis one of the biggest. It got its start in January 2014, one of many cryptocurrencies that emerged following Bitcoins then-immense rise in price. Many of these, known as altcoins, were used exclusively as vehicles for pump-and-dump schemes. Somebodyoften an altcoins creatorwould pick a coin to pour funds into, and hype would build. Novices would pile in, the price would spike, and the major investors would dump it, sending the price plunging downward.

The old Charlie Shrem was not above taking advantage. He claims he turned $50 into $15,000 on one altcoin (but also got badly burned on an altcoin intended to be a national cryptocurrency for Iceland, which shed half of its value in a single day).

Dash was one of the most popular altcoins. Originally known as Darkcoin because it promised untraceable transactions, it saw plenty of pumping and dumping. But its creator continued to refine the software and add new features. In March 2015 it rebranded as Dash, so people wouldnt mistake it for a single-feature coin, says Ryan Taylor, who leads its core team. Gradually Dash gained legitimacy. The total value of its currency has grown at triple-digit rates every year. Part of that is due to Bitcoins flaws. To attract customers, Taylor says, a new payment method needs to be faster, easier to use, and more secure than the alternatives. Bitcoin and most other digital currencies fail on all three metrics, he argues. Theyre certainly not faster or easier to use than credit cards, says Taylor, a former financial services consultant at McKinsey.

Dash has functions to address those weaknesses. It offers an instant send feature that Taylor says is as fast as using a credit card. To protect against fraud or theft, Dashs next versiondue out this yearwill include features such as moderated transactions, in which funds are released only upon the receipt of goods or services, and vault accounts, which give their owner 24 hours to stop an impending withdrawal of funds. The goal is to create a medium of exchange that can be used for everyday commerce.

Dashs clearest innovation, though, may be its governance system. All prospective projects must be submitted for a vote by people who hold at least 1,000 coins. The advantage of such a system, according to Olaf Carlson-Wee, the CEO of Polychain Capital, a hedge fund that invests exclusively in blockchain assets, is that it allows a decentralized network to make decisions rapidly, avoiding the sort of conflict now engulfing Bitcoin, which has little structure and no way to compel anybody to, say, adopt a new version of its software.

As Dash took off this spring, Shrem decided to get involved. He proposed creating a prepaid debit card. Youd load in, say, three Dash coins, which would then be converted into dollars (or euros or whatever). The cardholder could then use the card at any business that accepts a debit card. This could open the floodgates for hundreds of millions of dollars in digital currency to enter the mainstream economy. People only want to hold Dash if they can easily convert it to something of use, Taylor agrees.

There are several Dash-funded debit cards available, but Shrems would be the first that could be used in the U.S. His plan garnered overwhelming support within the Dash universe. Reputation plays an important role on the network, Taylor says. When someone like Charlie comes along, people take it seriously.

Charlie Shrem grew up in Sheepshead Bay, a predominantly Russian and Jewish neighborhood in deep Brooklyn. His parents are Orthodox Jews, and his father worked for a jewelry retailer, while his mother cared for Shrem and his two sisters.

Shy and awkward, Shrem blossomed upon discovering a knack for computers. He taught himself to code and became a presence in online hacker forums. In 2009, while attending Brooklyn College, he cofounded a daily deals site for electronics called Daily Checkout. He found he loved sales.

Shrem has claimed, with characteristic hyperbole, that he was one of the first 10 people in the world to know what Bitcoin was. That is likely exaggerated. By the fall of 2011, however, he was sufficiently established in the Bitcoin community to be credible as the CEO of a startup (albeit one he launched from his parents basement).

That startup, BitInstant, helped people acquire digital currency and move it between Bitcoin exchanges. Eventually it allowed customers to convert cash into bitcoins at banks such as Wells Fargo ( wfc ) and Bank of America ( bac ) , and (via partners including MoneyGram) at 700,000 locations across the U.S., Russia, and Brazil, including Walmart , 7-Eleven, and CVS stores.

Shrem, who was partnering with a 23-year-old Welsh coder named Gareth Nelson, handled the business end. He raised $10,000 from his mom and $120,000 from an angel investor named Roger Ver. But one person who declined to invest warned him that BitInstant had no safeguards to prevent money laundering.

That was fine with Shrem. It was fine, too, with a substantial portion of BitInstants clientele, users of Silk Road, who needed to exchange dollars for Bitcoins in order to buy drugs on the underground market. There was even a middleman, Robert Faiella, a plumber in Florida who had a sideline obtaining Bitcoins for Silk Road users.

Shrem soon figured out what Faiella was up to. But rather than shut him down, Shrem helped Faiella source money for drug transactions. BitInstants cash-processing company and Shrems partner wanted to put a stop to it. But Shrem simply encouraged Faiella to disguise his identity with a new username and email address.

The flow of money went on unimpeded. By the time Shrem finally cut him off, in late 2012, Faiellawho later pleaded guilty to operating an unlicensed money-transmitting business and was sentenced to four years in prisonhad laundered nearly a million dollars through BitInstant.

The libertarian defense for Shrems conductwhich he himself has advanced at timeshas two parts: first, that individuals have the right to do what they want with their money and their bodies as long as they arent harming anyone else; second, that at the time he began helping Faiella, the U.S. government hadnt determined how to classify or regulate Bitcoin. If the government hadnt even decided whether it viewed Bitcoin as money, the argument goes, how could one be laundering it?

The Bitcoin community in those days was united in its sense of righteous mission. Because the digital currency abjured central banks and other authorities, many of its first devotees were libertarians, anarchists, and black marketeers who wanted to do business away from the governments watchful eye. They were gleeful at any sign of Bitcoins impending triumph over the financial system, enraged by any show of incompetence or malice by the government or big banks. The free flow of capital, community members believed, is a human right.

Shrem embraced the outlaw stance. When a payment processor, under pressure from partner banks and Mastercard , cut all ties with Bitcoin companies, leaving customer funds stranded, it was BitInstant that hacked together a solution to let them withdraw their money.

By August 2012, when I first met him, Shrem was a 22-year-old CEO, a cocky, motormouthed capitalist and proud pothead. I interviewed him and his lieutenants in an office they dubbed the Bakery because of all the marijuana-fueled bull sessions that took place there after hours. One former employee, Rachel Yankelevitz, told me, Charlies main qualification for coworkers was if they could smoke weed or drink with him and chill together.

Shrem had swaggering ambitions. His company would soon be processing 30% of all Bitcoin transactions, and he wanted BitInstant to become the Apple of Bitcoin, as he told me at the time.

That fall, BitInstant raised $1.5 million in funding, most of it from Cameron and Tyler Winklevoss, who had started a venture capital firm. They had become interested in digital currency, and BitInstant helped them buy their first bitcoins. The twinswho later disavowed Shrem upon learning of his arrestwould go on to scoop up a reported 1% of all the bitcoins in existence.

After raising funds, BitInstants future looked bright. Because so much of the crypto-economy depended on fast money transfers in and out of the system, Shrems company became a barometer of the industry. During the Cypriot financial crisis in early 2013, when it appeared that the bank accounts of regular citizens would be taxed at 6.75% as a condition of a European bailout deal, Bitcoin suddenly looked like a safe haven, and its price shot up from $50 to $266a previously unimaginable high. Shrem became a millionaire almost overnight.

Then the wheels came off. First a dispute with the investors led to the ouster of Shrems two best friends at BitInstant. Something went out of him with their departures. He was often distracted. Hed spend the night partying, then sleep in and show up late.

The site, meanwhile, was straining under the surge in users, leading to waves of customer complaints. An upgrade to the platform became mired in technical problems and legal concerns. It became clear BitInstant had been operating without state money transmitter licenses (which, it became clear, some states would require to serve their residents), and the cost of obtaining them would be prohibitive.

It was all too much. BitInstant shut down in July 2013. Alex Waters, the companys chief information officer, says Shrem squandered the opportunity to make BitInstant a world-beating company and screwed over a lot of people. Customers were irate.

Shrem himself appeared at first to have gotten away unscathed. He was living on his own and enjoying his freedom. He and his girlfriend (now fiance), Courtney Warner, took a vacation to Morocco, where he says he tried opium. He flew to Argentina on a mission for the Bitcoin Foundation. His life was a whirlwind of partying and dealmaking. I have to take a lot of people out to clubs, buying bottles, buying dinners, he told a reporter in late 2013. His business now was not BitInstant but himself. He began to earn speaking feesand all the while he kept talking like BitInstant was going to be rebuilt better than ever. He was very arrogant, Warner says of her fianc during that time.

In January 2014 it all caught up with him. On his way back from a speech in Amsterdam, he was arrested. He eventually pleaded guilty to aiding and abetting an unlicensed money transmitter, and was sentenced to two years. I screwed up, he told the judge at his sentencing. Shrem had wanted to raise the issue of whether the law he had broken was just. But his lawyers discouraged it.

Other Bitcoiners had run afoul of the law, but Shrem was the first to serve time. This fact makes him, depending on your view, either a criminal who got his just deserts or a martyr. A lot of people say that I took the first shot for Bitcoin, Shrem says. The first person to walk through the door always gets shot, and then everyone else can come through.

Shrem entered prison in March 2015. He had put weight on his slight 5-foot-4 frame, medicating himself with vodka in the nervous months before he was incarcerated. Now, in the minimum-security federal prison camp in Lewisburg, Pa., he detoxed and began frequenting the prison library. He found himself pondering the question of value. What made currenciesof any formworth anything? As luck would have it, the prison economy provided the answer.

The prison had its own currency, one based on proteinmainly packets of mackerel in soybean oil. Good-quality protein is very hard to come by in prison, Shrem says. Tuna is good, but tuna doesnt have texture. Mackerel is meaty.

Inmates serving long sentences, he says, would stockpile mackerel, using it as a store of value, like a savings account. But those pouches of mackerel expire in three years. People started transacting these mackerels that were expired, Shrem explains. They called them money macks. The money mack had a value of about a dollar, whereas eating macks had a value of about $1.50. And they had exchangers. The money macks had no valueexcept that everyone said they had value.

Gradually he came to believe, as some monetary theorists do, that the acceptance of certain forms of moneyshells, colored beads, pieces of paperis largely a social convention, dependent upon what technologists would call their network effect.

But it was clear that certain features could make one type of currency more suitable than another. Money macks were an ideal form of money for inmates. They were scarce, Shrem says. The only way you could get money mackerels was from edible mackerels that expired. And the inflation rate of edible mackerels was set. You had 500 inmatesevery inmate could only buy 14 mackerels every week in the commissaryThats how many mackerels at any time, at maximum, could come into the system. Theres no arbitrary printing of mackerels; theres no flooding of the market with this food. Its like Bitcoin. There was no Federal Reserve of mackerel that was printing whenever they wanted.

Bitcoin, he knew, has qualities that make it a powerful currency, store of value, and payments network. But expecting it to do more than that was asking too much, he decided. Thats when its going to fail, he says. Trying to do smart contracts, and social media, and a distributed file-storage system, and all these different things on top of the Bitcoin blockchainits like trying to have your browser do everything for you. Better to let a thousand crypto-flowers bloom, each one focusing on what it does best.

Many of the hottest blockchain assets today are not digital currencies like Bitcoin or Dash, but so-called tokens, distinguished from true cryptocurrencies by their lack of a blockchain. They run instead on existing blockchains, primarily Ethereums, and tend to be built for specific applications, such as a peer-to-peer marketplace for computation (Golem), a crowdsourced prediction market (Augur), or a blockchain-based advertising platform (Brave).

Where digital currencies are generally mined, tokens are usually distributed in crowd sales known as initial coin offerings (ICOs). (After that, they trade on public exchanges.) These crowd sales serve both to raise funds and to give potential investors their first chance to grab a piece of whatever service is being built. Dozens of ICOs have already been launched, raising more than $230 million last year, followed by more than $450million just in the first half of 2017. (For more on investing in tokens, and their uncertain legal status, see Why Tech Investors Love ICOsand Lawyers Don't .)

The tokenization craze constitutes nothing less than the second business model of the Internet, contends Carlson-Wee, whose hedge fund is backed by Andreessen Horowitz. Imagine if Facebook had issued a token to its users, with its value deriving from the content and connections generated on the social network. Early users might have scooped up large quantities of the token at rock-bottom prices, while those who joined later, as the networks value became widely apparent, might find themselves able to afford only a few. But all of them, by holding this digital asset, would be able to participate in Facebooks growing success.

This, of course, is not the case. The $435 billion value of Facebook is shared only among Mark Zuckerberg and other stockholders. Most other Internet platforms operate on the same principle. Their owners extract massive value from interactions between users.

With blockchain-based systems, by contrast, theres no longer a division between users and owners, Carlson-Wee says. The tokens are a wealth-sharing mechanism, a way that everyone from hedge funders to consumers can take positions inand place bets onthe future of the Internet.

Shrems reentry into civilian life was a two-step process. He was transferred to a halfway house in Harrisburg, Pa., in March 2016. Shrem says living not merely with embezzlers, fraudsters, and drug dealers, as he had in Lewisburg, but also with murderers, bank robbers, child molesters was worse than prison. He cried his first night there. During this time, Shrem worked as a dishwasher at a restaurant for $8 an hour. Gainful employment was a condition of residency at the halfway house. Playing around with magical Internet money didnt qualify. They were very specific, Shrem says.

If being a dishwasher humbled him, it was still more humbling to realize how much the Bitcoin community had changed in his absence. Familiar landmarks were gone. When he tried to visit one of his old haunts, an online exchange where hed once speculated in altcoins, he found the site no longer existed. Even the lingo had changed.

Shrem set about catching up on what hed missed. In prison the library had been his sanctuary: He would stay in there for hours. He says he read 137 books while incarcerated. Now he took the same approach with the blockchain industry. Marco Santori, a cryptocurrency attorney at the law firm Cooley, likens Shrems reeducation to that scene in Austin Powers where hes unfrozen after 40 years or whatever it is, and he just watches 40 years of history straight through to try to get his bearings.

That didnt stop Shrem from stumbling out of the gate. Having seen that token sales were the new frontier, he became the chief technology officer of a startup called Intellisys Capital, which he predicted was going to revolutionize the investment world. The idea was to raise funds for a portfolio of middle-market companiesand, later, blockchain startupsby issuing $25 million worth of tokens in an ICO. It seemed like a really cool idea, Shrem says.

The problem was that their token would almost certainly be classified as a security under U.S. law. To avoid legal trouble, Intellisys decided to bar American and British citizens from participating in the sale. But the plan had drawbacks: They would have to rely on partners to vet prospective investors for them.

Shrem became the face of the venture. He was back in pitch mode, touting Intellisys to the press and the public. He described the funds planned first investment, a 20-year-old waste-management company in Michigan, as a proof of concept.

But as the date of the token sale was pushed back, from mid-January to the end of February, Shrem began to get cold feet. Selling a security could bring all kinds of scrutiny to a man already convicted of a financial crime. I still get these nightmares Im in prison sometimes, he tells me in March. He was becoming increasingly nervous.

Fortunately for him, fate intervened. The ICO, held at the end of February, was a bomb. We had a bunch of technical problems, says Shrem. We raised a few hundred thousand dollars, and then we refunded everyones money. Shrem decided to walk away. It was easier to take the hit to his reputation than live in fear.

Thats one of the paradoxes of cryptocurrency: Each new development seems to bring both great promise and great peril. ICOs are the next big chapter, after crowdfunding, in the democratization and decentralization of finance, says Brock Pierce, a co-founder of a San Francisco venture capital firm, Blockchain Capital, that invests in cryptocurrency startups. His firm recently raised $10 million by issuing its own blockchain token, becoming the first venture capital firm in the world to do so. (The token sold out in six hours.)

But many of the ICOs conducted so far have played fast and loose with regulations, he says, operating in a gray area. I dont like the way that people are going about doing it, says Pierce. That the SEC hasnt yet cracked down means nothing, he says. Good entrepreneurs with the best of intentions, who want to innovate and change the world, are going to end up in jailor with fines.

Shrem agrees. I try to explain to people that in any other industry its okay to try new things and break shit, but in fintech, because youre talking about peoples money, its a lot more difficult, he says. Especially in the Bitcoin and blockchain space. The government is always watching.

For now, though, the ICO market is surgingdespite fears of a bubble and scamsand mainstream investors are entering. In May, billionaire venture capitalist Tim Draper, long bullish on Bitcoin, announced that he would take part in an ICO for the first time. The crowd sale, planned for July, is for the token powering Tezos, a smart-contracts platform that Draper says will be more secure and more democratic than Ethereum.

Draper says he expects in the future to see tokens for everything from health care to insurance to commodities. Tokens, he says, are both a brave new frontier and a Wild West.

The failure of Intellisys cost Shrem. I expended social capital on it, he says. And Ill have to get that back. In March he tells me that he wants to make a comeback, but it has to be the right sort of comeback. I need to show that I didnt just get lucky one time with BitInstant, he says, but that I know what Im doing.

He had moved to Sarasota with his fiance and was living with her and his future mother-in-law in a rented pink townhouse. He was spending his abundant off-hours relaxing on the beach, eating in nice restaurants, boating, Jet Skiing. He was mellower and more patient than in the past. He decided that if an opportunity came to get in on the ground floor of something amazing, he would seize it. That turned out to be a full-time job as Jaxxs head of business and community development. The companys values appealed to him: Jaxx users are in control of their own funds. It goes toward my vision of you being in control of your own money, you being in control of your own freedom, he says.

March was the first profitable month for Jaxx, which lets users (now more than 100,000) exchange one virtual coin for another. Now its founder, Anthony Di Iorio, who cofounded Ethereum, wants to expand to other countries, such as China, and Shrem will be a key part of that process. He is in charge of turning relationships into revenue, working with developers to add their cryptocoins to Jaxxs stable. Dozens of new partnerships are in the works.

But they have to be the right coins. Having helped Bitcoin grow from a stripling to a giant, Shrem is confident he can tell which crypto-projects have real promiseand which dont. He thinks if he can help build Jaxx, hell be a major industry player again.

His timing may be good. According to Carlson-Wee, the real Cambrian explosion of tokenized assets is still a couple of years away. Thats when he expects to see technology that would let Bitcoin, Ethereum, Dash, and other blockchain networks communicate. As it stands, theyre isolated from one another. (The concept has spawned another name in the argot: parachains, a reference to the idea of bringing parallel blockchains together.)

Parachains would allow applications and smart contracts built on one system to interact with another systems assets. An Ethereum smart contract could be triggered by the balance in a Bitcoin wallet address, for instance. This would help overcome the network effect of the oldest cryptocurrency. Just as Bitcoin faces an uphill battle against currencies like the U.S. dollar, so new cryptocurrencies are at a disadvantage to Bitcoin, which has the broadest name recognition and biggest user base.

Forging bonds between blockchains would allow users to flow easily from Bitcoin to Dash to Ethereum to Zcash, strengthening the entire ecosystem and making all of it more valuable. As long as youre keyed into any cryptocurrency, youll have access to every cryptocurrency, Carlson-Wee says.

Bitcoin was created to be the money of the Internet. Its successors may build a new kind of Internet, a Web 3.0 of interconnected blockchains running countless applications. Charlie Shrem is determined to be in the middle of it all.

Brian Patrick Eha is the author of How Money Got Free: Bitcoin and the Fight for the Future of Finance .

A version of this article appears in the July 1, 2017 issue of Fortune. Weve included affiliate links in this article. Click here to learn what those are.

See more here:

Bitcoin: Can Cryptocurrency Become a Trillion-Dollar Market ...